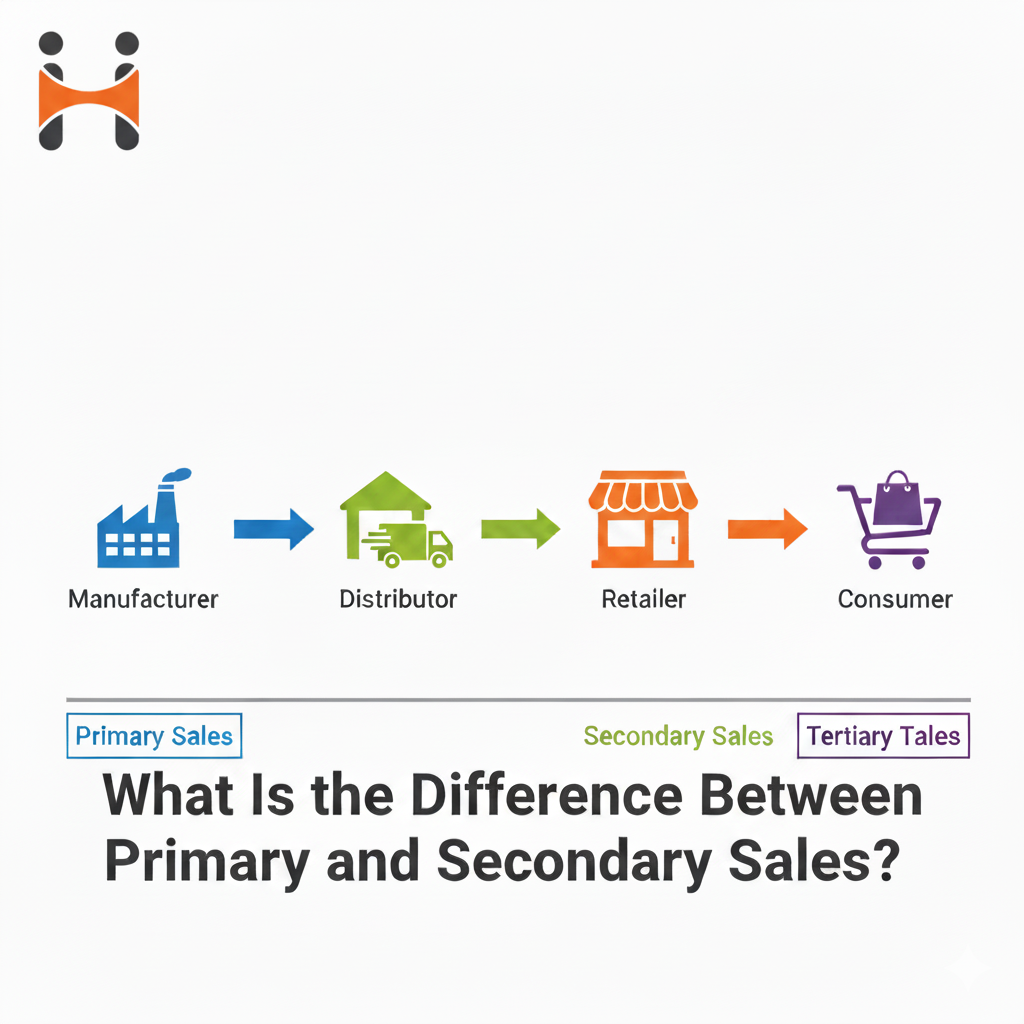

What Is the Difference Between Primary and Secondary Sales?

If you’re running a sales crew or handling a distribution setup, you gotta know what’s up with primary and secondary sales-it’s like the secret sauce for winning. Primary sales? That’s when stuff goes from the factory to the distributors, like the first handoff. Secondary sales are how those products get from distributors to the shops selling to folks like us. Keep an eye on both, and you’re gonna nail your stock game, plan like a pro, and boost those sales. Throw in some field force automation apps, and your team can track what’s poppin’ live-see who’s hustling hard and turn all that sales info into straight-up gold.

What are Primary Sales?

- Definition: Primary sales are transactions where the manufacturer or principal sells products to an intermediary-typically a distributor, wholesaler, or stockist.

- “X” involved? Manufacturer → Distributor.

- Purpose: Move bulk inventory into the distribution channel; generate revenue for the manufacturer; fulfill replenishment and stocking agreements.

- Key metrics: Purchase orders raised, invoice value, delivery quantities, dealer/stockist receivables, onboarding of new distributors.

Why it matters: Primary sales tell you how much stock you’ve supplied into the market pipeline. They are critical for production planning, manufacturing schedules, and cash flow forecasting.

What are Secondary Sales?

- Definition: Secondary sales (often called “sell-through”) are transactions where distributors or wholesalers sell goods to retailers, modern trade, or directly to trade customers.

- “X” involved? Distributor → Retailer/Dealer (or B2B customer).

- Purpose: Show real market demand, track product movement on shelves, confirm demand, and prompt restocking.

- Key metrics: Retailer sales invoices, SKU sell-through rates, retail stock-outs, collections, POS receipts.

Why it matters: Secondary sales are the true signal of consumer demand. You can’t properly forecast where to produce or how to route stock without accurate secondary sales data.

What are Tertiary Sales?

- Definition: Tertiary sales refer to the final step—retailer or point of sale selling to the end consumer (retailer → consumer).

- “X” involved? Retailer → End customer.

- Purpose: Get people to buy the brand, grab more market share, and prove the product fits the market.

- Key metrics: Store sales, customer receipts, retail sell-out numbers, how fast SKUs sell.

Why it matters: For lots of manufacturers, data from this level shows if promotions work, how price changes affect sales, and what customers really do.

Primary vs Secondary vs Tertiary Sales – Quick Comparison

| Aspect | Primary Sales | Secondary Sales | Tertiary Sales |

| Flow | Manufacturer → Distributor | Distributor → Retailer | Retailer → Consumer |

| Main metric | Invoice to distributor | Sell-through to retailer | POS/consumer purchases |

| Visibility challenge | Easy to track (manufacturer invoices) | Harder — depends on distributor reporting | Hardest — requires retailer/POS integration |

Key use | Production & supply planning | Demand sensing & replenishment | Marketing effectiveness & consumer insights |

Short answer for a decision-maker: Primary = supply, Secondary = distribution execution, Tertiary = consumer demand. You need all three for a robust sales distribution strategy.

Why the Difference Matters for Your Distribution Strategy?

- Forecasting accuracy: Forecasts based only on primary sales assume sell-through equals supply. That’s optimistic at best. Secondary data corrects that assumption.

- Stock optimization: If you only track primary sales, you risk overstock at distributors and stockouts at retail. Secondary and tertiary views enable balanced inventory.

- Promotion ROI: Promotions measured at retail (secondary/tertiary) validate whether discounts or merchandising actually produced sales.

- Collections & working capital: Secondary sales visibility helps finance teams reconcile distributor receivables versus real retail collections.

- Execution & accountability: Knowing where and when field teams visit stores (and what they do there) is essential to close the loop between plan and reality.

Common Challenges in Tracking Primary & Secondary Sales

- Data silos: Primary invoices are typically in an ERP; secondary sales sit with distributors or at POS systems. Consolidation is rare without integration.

- Delay in reporting: Distributors often report weekly or monthly – too slow for daily execution fixes.

- Inconsistent formats: Different distributors report in different templates, causing manual reconciliation errors.

- No field-level visibility: Managers don’t know if reps actually visited stores, executed promotions, or submitted accurate orders.

- Offline markets: Many retail outlets – especially in rural or low-connectivity zones-operate offline, making real-time reporting tricky.

From our experience working with field sales teams, these issues turn a straightforward distribution model into a guessing game. One retailer using a field force automation approach saw measurable lift in store coverage after standardizing reporting flows; that kind of operational clarity starts with tracking.

How to Track Primary and Secondary Sales?

To manage sales distribution, companies need good systems and solid fieldwork. Here’s how to do it.

- Link ERP to distributor reports. Connect primary invoice data from your ERP to distributor sales reports. Auto-reconcile when you can.

- Get secondary data straight from the source. Have distributors use an app or upload POS reports. Daily sales apps give you real data instead of weekly guesses.

- Use GPS to track field activity. GPS-verified visits confirm sales calls happened. If a rep says they visited but GPS doesn’t match, follow up.

- Support offline data collection. Field tools should work offline and sync when online. This matters for rural areas.

- Use a single dashboard. Put primary, secondary, and tertiary metrics together to see gaps and opportunities.

- Improve forecasts. Use past primary and secondary data plus field team input for better short-term predictions.

Where Technology Makes the Difference (and Why Field Force Automation Matters)?

Manual aggregation of invoices and retail statements is slow and error-prone. The field is messy: missed visits, delayed collections, and inconsistent order entry. That’s why modern distribution leaders use field force automation platforms to:

- Capture sales, orders, and collections at the point of activity (mobile-first experience for field reps).

- Verify activity with GPS and timestamps, eliminating disputes over whether a visit happened.

- Provide real-time KPI dashboards that show store coverage, sell-through, outstanding collections, and target achievement.

- Sync offline work when connectivity returns, ensuring no visits are lost.

- Enable route optimization & reminders, improving the number of productive visits per day.

- Feed forecasting models with timely secondary sales and qualitative field notes.

When teams use such systems, primary invoices and secondary sell-through data become living inputs to forecasting and strategy rather than stale spreadsheets.

How Happisales (Company Perspective) Solves These Problems?

At Happisales we’ve seen the transformation that happens when companies combine data discipline with field execution. Here is how our platform supports a full distribution view:

- Primary sales visibility: Auto-import or reconcile primary invoices from your ERP so you always know how much stock you’ve supplied to each distributor.

- Secondary sales capture: Field reps and distributor agents log retailer orders and sell-through at POS; this data feeds dashboards every day.

- Tertiary indicators: Where retailers are integrated, POS feeds or photographed invoices enrich tertiary insights.

- Location tracking & verification: GPS-verified visits and geofencing show actual store coverage. Managers can see “who visited which store and when.”

- Daily sales reporting & KPIs: Customizable dashboards let you track visits-per-day, sales-per-rep, collection efficiency, and stock-outs.

- Offline-first mobile app: Field staff record activities without internet; everything syncs automatically next time they’re online.

- AI-powered suggestions: Our ML features spot underperforming routes and suggest priority visits based on historic sell-through and current stock levels.

From our customer interactions, bringing these pieces together tends to increase retailer coverage and reduce stock-outs. One client reported a notable improvement in store visits after enforcing GPS-verified visits and route planning – small operational changes with visible business outcomes.

Why Secondary Data Improves Predictions (Sales Forecasting Techniques)?

Forecasting is only as good as the data you feed it. Here are ways to combine primary and secondary signals for better forecasts:

- Quantitative methods. Use time-series analysis, moving averages, and regression with shipment and sell-through data.

- Qualitative methods. Get input from field reps, distributors, and market trends. These help during launches or promotions.

- Hybrid forecasting. Mix historical sell-through data with real-time field input and AI for short-term restocking predictions.

When secondary data is current (daily/weekly), forecasts become actionable-reducing both overstock and lost sales.

What’s Next?

The Better Question Is Not Which Layer Wins, But How You Link Them. Primary sales tell you what you shipped; secondary sales tell you what actually moved; tertiary sales tell you whether the consumer bought it. None of these layers are optional if you want a reliable sales distribution strategy.

If your goals include tracking employee location, reducing missed visits, improving sell-through, or tightening collections, you need a system that captures field activity reliably and merges it with primary and tertiary signals. That’s what field force automation is for: a practical, tactical bridge between plan and reality.

Ready to stop guessing and start acting? Try a free demo of Happisales (14 days, no credit card) and see how GPS-verified visits, daily sales reporting, and reconciled primary/secondary dashboards can turn your distribution chain from opaque to orchestrated.